Introducing Taxes 365 by Every

.png)

As the founder of a startup, you're excited to tackle complex challenges that await you. Unfortunately, amidst the thrill of turning your innovative vision into reality, you're confronted with one of the most dreaded words in the entrepreneurial lexicon: taxes.

Enter the financial ally you've been waiting for—Taxes 365 by Every.

The Relentless Tax Problem

Every year, founders face countless questions like "Which taxes does my startup need to file?" and "How can I ensure compliance without diverting attention from my core business?"

The issue is further complicated by varying tax laws, stringent deadlines, and intricate calculations. This constant whirlwind leaves you grappling for control, itching to return to what you do best—growing your startup.

The Game-Changing Solution: Taxes 365

Enter Taxes 365, the revolutionary tool you've been searching for—an all-in-one solution that demystifies the maze of corporate taxes, the R&D Tax Credit, the Delaware Franchise Tax, and more. Designed specifically to empower tech startups like yours, it frees you from the clutches of financial uncertainty and back-office woes.

With Taxes 365 handling all your tax needs seamlessly, you can turn your undivided attention to where it truly belongs: nurturing your startup towards unparalleled success.

Corporate Taxes, Credits, and Beyond

Taxes 365 ensures effortless management of all your corporate tax requirements. Our service handles end-to-end tax compliance with optimal ease and precision, ensuring that your startup is always on the right side of the law.

We manage all the taxes your startup needs to file, like the R&D Tax Credit applications and Delaware Franchise Tax filings, ensuring that your startup maximizes the benefits available to you while steering clear of any last-minute setbacks.

Essential Financial Statements

Navigating the financial course of your startup is a vital aspect of your entrepreneurial journey. Taxes 365 provides you with easily accessible and accurate P&L, balance sheet, and cash flow statements that empower data-driven decision-making.

This financial clarity is crucial to fuel informed choices and incite confidence among stakeholders, investors, and partners alike.

Giving Power Back to Founders

At the heart of Every is the belief that founders like you shouldn't be burdened with tedious back-office tasks.

Taxes 365 aligns with this conviction, providing a tax solution that enables you to focus on your startup's growth. By leveraging the comprehensive tax management capabilities provided by Taxes 365, you can breathe a sigh of relief, knowing that your financial health is well-maintained.

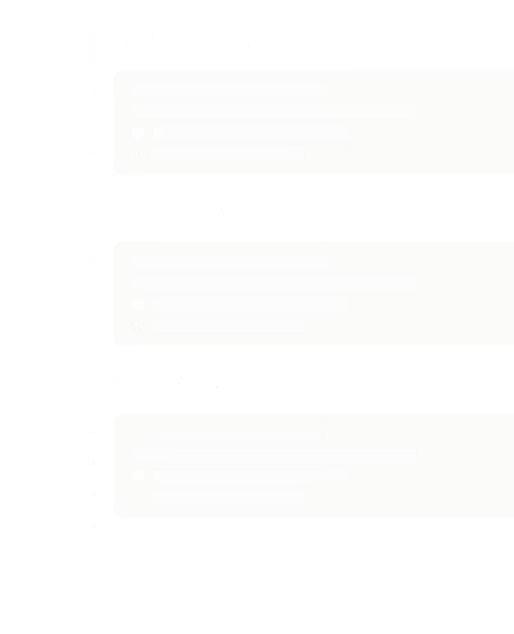

For example, the list below shows all the key tax deadlines for startups. By leveraging the comprehensive tax management capabilities of Taxes 365, you can breathe a sigh of relief, knowing that your financial health is well-maintained because we handle all of this filing for you.

- 1/31: W2s to employees and 1099s to contractors

- 2/28: IRS Affordable Care Act (ACA) Compliance, if paper-filing (eFiling deadline is March 31).

- 3/1: Delaware Annual Franchise Report filing

- 3/31: IRS ACA Compliance (eFiling). File 1099s and W2s with the IRS by this date.

- 4/15: C Corporation Form 1120 Tax Return, 1st installment of the Federal Quarterly Estimated Tax, and report foreign bank and financial accounts with FinCEN Form 114 (FBAR).

- 4/30: Claim R&D Tax Credits on Form 941.

- 6/16: Delaware Quarterly Estimated Franchise Tax, and Federal Quarterly Estimated Tax 2nd installment due.

- 7/31: Claim R&D Tax Credits on Form 941 for the second quarter.

- 9/15: Federal Quarterly Estimated Tax 3rd installment.

- 9/30: Quarterly Sales and Use tax filing.

- 10/15: Final due date for C Corp Form 1120 Tax Return if an extension was filed.

- 10/31: R&D Tax Credit Form 941(Q3) to claim R&D credit against payroll taxes.

- 12/15: Federal Quarterly Estimated Tax 4th installment and Delaware Quarterly Estimated Franchise Tax due.

Reaping the Benefits of Taxes 365

Taxes 365 not only saves you countless hours but also valuable resources. By offloading the responsibility of tax management and financial statement generation onto Taxes 365, you effectively direct more energy and attention toward your product, sales, and marketing efforts.

Replace the stress of tax compliance with confidence, maximize government returns, and ensure that your books are VC-ready—all with the support of Taxes 365.

Making Your Next Move: Embrace Taxes 365

The time has come for tech startups like yours to transform the way you approach taxes and financial management. The future is bright—complete with a sense of financial assurance and focus on your core objectives.

Embark on this new journey with Taxes 365, and begin steering your startup's financial narrative with unwavering confidence. Allow Taxes 365 to become the unbeatable solution to all your tax challenges, and watch as your innovative venture takes flight.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

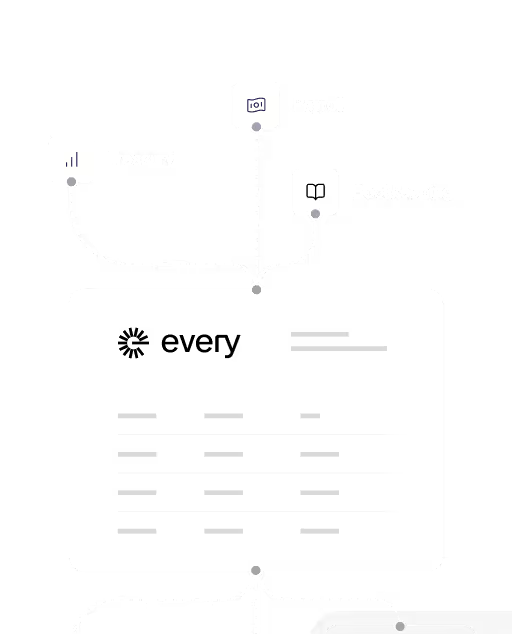

- What features does Every offer?

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?