When to Set Up Accounting for Your Tech Startup

.svg)

Being at the helm of a tech startup is exhilarating—the late nights, the breakthroughs, the uncharted waters. Yet, in the midst of coding sprints and product launches, it's easy to overlook one of the most critical components of your startup's long-term success: accounting.

As veterans in the entrepreneurial journey, we've seen too many bright visions dimmed by financial mismanagement. It's why we champion the integration of solid accounting practices from day one. So, let's explore the ideal timeline for setting up your startup's accounting system, ensuring your focus remains on innovation and growth, not damage control.

Day One Is Accounting Day One

Imagine launching your product with a clear financial trajectory rather than back-tracking to untangle messy records. From the first day, treating accounting as a cornerstone rather than an afterthought sets a firm foundation.

Here’s the groundwork to be laid:

- Business Bank Account: Separate your personal and business finances to simplify tax time and give you a clear picture of your burn rate.

- The Right Tools: Choose accounting software that grows with you, like QuickBooks Online or Puzzle.

- Capturing Receipts: Choose a card (such as ours) that automatically requests receipts on spending over $75 and pushes them to Quickbooks. By the time you have an audit down the road, you’ll likely lose them, so you’ll be grateful to have them all recorded in one place from the start.

Navigating Through Compliance and Taxes

Regulatory compliance and tax obligations don't have to be the bane of your existence. A proactive approach to accounting ensures you're always ahead of the game, avoiding fines, audits, and the stress that comes with them. Let Every shoulder the burden, giving you peace of mind that regulatory requirements are not just met, but optimized for your benefit.

Raising Capital—The Crucial Role of Transparent Financials

When the time comes to seek investment, your financial records become your startup’s resume. Many investors request information rights that require financial statements. Once you have a board, the board will also look over these financial statements at board meetings. Accurate, transparent accounting practices build investor confidence and can significantly affect the length and outcome of funding rounds.

With Every, our platform ensures your financials are organized and easily accessible, turning potential investor scrutiny into investor confidence.

Scaling With Your Growth

As revenue begins to flow, the complexity of your financial landscape intensifies. This is where robust accounting practices prove invaluable.

They enable you to manage cash flow effectively, make strategic hiring decisions, and understand the profitability of your services or products. It’s about having the pulse of your startup’s vitals, always.

Making Every Moment Count

Starting with accounting from day one isn't just about financial management—it's about cultivating a mindset focused on sustainable growth and innovation. As seasoned founders ourselves, we understand the intricacies of startup growth and the paramount importance of efficient operations.

Don't let accounting be an afterthought. Partner with a platform that understands and caters to your needs initially. Try our solution today and see how much more you can achieve when financial management is efficient, focused, and, most importantly, empowering.

It's time to unlock your startup's full potential. With Every, the future isn't just bright; it's clear and controlled. Welcome to the new standard of startup growth.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

- What features does Every offer?

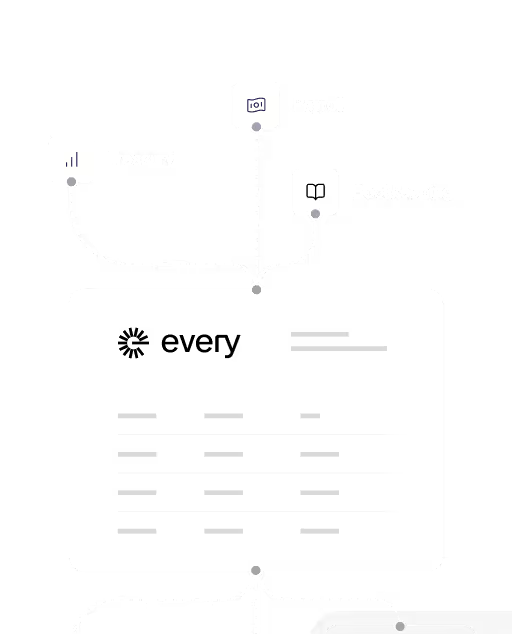

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

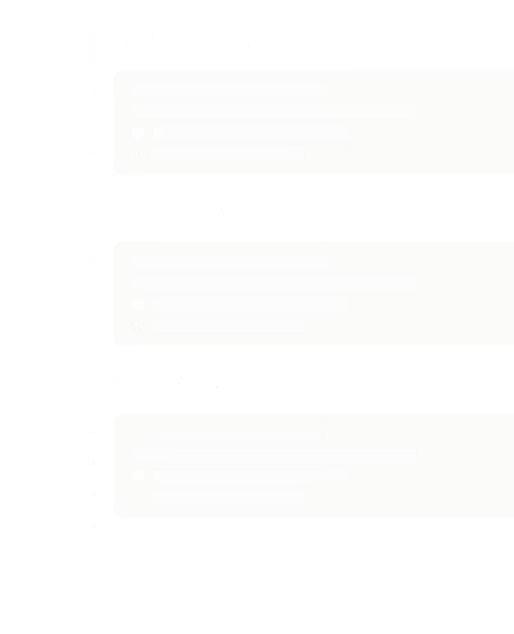

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?