List Of Startup Funding Programs In Alabama - 2025

What Are The Startup Funding Programs In Alabama?

Alabama offers several programs to help startups access the funding they need to grow. These programs provide various types of support, including grants and loans, tailored to both new and expanding businesses.

Eligibility Criteria For Funding Programs

Startups in Alabama must meet specific criteria to qualify for funding. First, businesses generally need to be registered and operating within the state. This ensures that the funds benefit the local economy by supporting Alabama-based businesses.

Additionally, many programs prioritize startups in sectors like technology and innovation. This focus aims to stimulate growth in industries that can significantly impact the state. Programs like the Alabama Launchpad, part of Innovate Alabama, often require that businesses demonstrate potential for growth and sustainability.

Some programs may also have specific financial or operational requirements, such as matching fund commitments or detailed business plans. Entrepreneurs should review the specifics of each program to make sure their business qualifies.

Types Of Funding Available

Alabama offers a mix of funding options to meet various startup needs. Government grants such as those from Innovate Alabama are available for businesses engaged in research and innovation. These grants often support ventures in early development stages.

Another popular option is the Alabama Small Business Loan Program, which provides loans to help businesses leverage capital for growth. The program aims to complement private sector lending, enhancing the financial resources available to small businesses.

Venture capital and angel investor networks also provide significant funding opportunities. Opportunities like those through local incubators can help startups access both capital and mentorship, giving them the tools needed for successful launches and expansions. For entrepreneurs, exploring these diverse funding sources can provide the financial boost necessary to thrive in Alabama's competitive business landscape.

How To Apply For Startup Funding In Alabama?

Applying for startup funding in Alabama involves understanding the application process and gathering the required documentation. This ensures that entrepreneurs are well-prepared to take advantage of available opportunities.

Application Process Overview

The application process varies based on the specific funding program you are targeting. Many startups in Alabama begin by exploring programs offered by the Small Business Administration (SBA) like the Innovate Alabama Supplemental Grant Program. These programs often require that applicants submit a proposal showcasing their business objectives and potential for innovation and growth.

Applicants may also need to attend training or counseling sessions to understand the nuances of the application process. It is crucial to follow each program’s guidelines and deadlines strictly to increase the chances of success. Entrepreneurs can find more about various programs and their requirements by visiting Alabama Small Business Grants.

Required Documentation For Application

Proper documentation is essential for the successful application of funding. Startups are usually required to submit detailed business plans. These plans should include financial projections, business goals, and market analysis. For some specific programs, additional documents like proof of SBA counseling or records of training sessions attended may be necessary.

Startups may also need to provide personal financial statements and tax returns. Certificates related to the business structure, like articles of incorporation or partnership agreements, might also be requested. Precise documentation proves the credibility and readiness of the startup, enhancing the likelihood of securing funds. For more guidance, startups can consult local resources or visit Small Business Funding Programs in Alabama.

Which Sectors Have The Most Opportunities For Funding?

In Alabama, certain sectors are attracting significant funding opportunities. The tech industry and healthcare sectors are leading the way, providing startups with many options for financial support.

Tech Industry Funding Options

The tech industry in Alabama is booming with opportunities. High-growth startups in this space can tap into a variety of funding sources. Federal research funds are a key resource, particularly for tech companies focusing on innovative projects. Startups should also explore partnerships with Auburn University for potential research collaboration and funding assistance.

Debt financing is another option, especially for tech startups that are scaling rapidly. Financial institutions in Alabama offer loan programs tailored to tech ventures. For more insights into tech startup funding, check out the latest trends.

Healthcare Sector Opportunities

The healthcare sector in Alabama provides robust funding opportunities. Startups in this field can benefit from grants aimed at healthcare improvement and innovation. Both state and federal programs support research in medical and healthcare technologies, which is vital for scalable growth.

Collaborations with universities like Auburn University are encouraged for startups wanting to leverage academic research and funding. These partnerships can help secure resources for cutting-edge projects. Startups can also consider joining industry-specific incubators for additional support and mentorship. For a detailed list of funding options tailored to your industry, explore the top-funded startup industries.

Who Are The Major Investors In Alabama's Startup Scene?

Alabama's startup landscape is supported by a mix of venture capital firms and angel investors. These entities play a crucial role in providing the financial backbone and mentoring that startups need to thrive.

Venture Capital Firms In Alabama

Venture capital firms are vital for startups seeking to scale rapidly. In Alabama, these firms offer more than just funding. They provide guidance, resources, and networking opportunities. Alabama Launchpad stands out as a significant player, offering competitions and ongoing mentoring. Other firms, such as Founders Advisors, headquartered in Birmingham, also contribute to the region's entrepreneurial ecosystem. These firms are instrumental in driving innovation by investing in tech and non-tech startups alike.

Angel Investors Active In The Region

Angel investors in Alabama focus on seed funding for emerging businesses. They typically invest between $100,000 to $1 million in startups, usually in exchange for equity. These investors often look for promising startups with strong potential for growth. The database of angel investors in Alabama provides insights into their activities and expectations. Angel investors offer not just financial backing, but also mentorship and industry connections, which are invaluable for new entrepreneurs working to establish their brand and expand their market reach.

Why Choose Alabama For Your Startup?

Alabama offers numerous advantages for startups, including economic incentives and a supportive community. These factors contribute to a thriving environment for new businesses.

Economic Benefits Of Starting In Alabama

Alabama provides significant economic benefits for startups. Entrepreneurs can access various state grants and programs aimed at fostering growth. One such example is the State Small Business Credit Initiative, which supports small businesses with credit and investment opportunities.

Huntsville, in particular, is a growing hub for technology and innovation, attracting new businesses with its skilled workforce. Additionally, the low cost of living and affordable real estate in Alabama allows for lower operational costs, making it an attractive option for founders. The Economic Development Partnership of Alabama (EDPA) holds competitions offering funding for startups, enhancing the state’s commitment to entrepreneurship.

Supportive Community And Resources

Alabama’s supportive startup community is a major draw for new businesses. Entrepreneurs can connect with mentoring programs and business advisors, providing guidance and support. The Small Business Development Center offers resources for startups to navigate challenges and grow effectively.

Founders in Alabama benefit from a network of innovation-focused organizations, such as Innovate Alabama, which supports female entrepreneurs and offers various resources. Workforce development initiatives aim to provide skilled employees, encouraging job creation and economic growth. This strong community foundation aids startups in building sustainable operations for long-term success.

What Challenges Do Startups Face In Securing Funding?

Startups often face difficulties in securing necessary funds to kickstart and grow their business. This section will address common obstacles such as lender requirements and provide strategies like leveraging programs like the State Small Business Credit Initiative to overcome these challenges.

Common Obstacles In Funding

One major hurdle is meeting stringent lender requirements. Many lenders ask for strong business plans and proof of financial stability, which can be hard for new businesses to provide. Another challenge is limited access to networks of investors, making it difficult to secure venture capital.

Startups might also struggle with building investor confidence. Without a track record, convincing investors of a business's potential is challenging. Moreover, competition for funding is fierce, especially in niche markets, leaving some startups overlooked.

Strategies To Overcome Funding Challenges

To tackle these obstacles, startups can explore programs like the State Small Business Credit Initiative. Such programs offer financial support to small businesses, helping them meet lender criteria and expand their networks. Engaging with local opportunity funds is another valuable strategy for gaining investor attention.

Startups can also work on crafting compelling pitches tailored to showcase unique value propositions. This clear articulation can enhance investor engagement. Additionally, forming partnerships can strengthen credibility and attract more funding avenues.

Online platforms that connect startups with investors, like onEntrepreneur, can also open new pathways to funding. These platforms offer extensive networks and resources, making them valuable tools for startups seeking financial backing.

When Is The Best Time To Seek Funding For Your Startup?

Timing plays a key role in seeking funding for a startup. Before approaching investors, startups should establish a clear business plan and have a minimum viable product (MVP) ready. Initial traction or user feedback can also make startups more appealing to investors.

Different stages of a startup may require different types and amounts of funding. Seed funding is typically sought after validating the concept and needing to scale further. Startups with a prototype and initial market feedback may consider seeking growth stage funding.

Funding should be sought when additional resources are necessary for expansion or development. Access to resources such as capital can significantly help in hiring, marketing, and product development. Before reaching out, startups must evaluate if they are financially prepared to demonstrate growth potential.

External factors also play a role in timing. Market conditions and economic environments can impact investor interest. By monitoring industry trends and economic factors, startups can choose an optimal time to pursue funding. They might explore options like bridge financing during transitional periods. More insights can be found on the right time to seek funding.

In summary, startups should ensure they have a promising product, good market feedback, and necessary preparations in place before seeking funding. Taking into account internal readiness and external conditions will enhance their chances of securing the required capital.

Frequently Asked Questions

Startups in Alabama have access to a variety of funding options tailored to different needs. From eligibility criteria to specific grants for women entrepreneurs, this section answers common questions about available resources.

What are the eligibility requirements for small business grants in Alabama?

Small business grants in Alabama often require businesses to be based in the state and demonstrate a need for funding to grow. Programs like the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) offer funds for research and development.

How can women entrepreneurs access small business grants specific to Alabama?

Women entrepreneurs in Alabama can explore resources such as the Amber Grant and Hello Alice. These grants focus on supporting female founders by providing capital to help launch and expand their businesses.

What federal grant options are available for startup businesses in Alabama?

Federal options include programs like the Small Business Innovation Research and Small Business Technology Transfer initiatives. These offer financial support for innovative projects. Additionally, Grants.gov provides a centralized hub for finding various federal funding opportunities.

What steps are needed to apply for the Revive Alabama Small Business Grant?

Applicants need to gather financial documents and a clear business plan. The Revive Alabama Small Business Grant may have specific criteria, so it’s important to review all requirements before applying.

How does the Innovate Alabama Supplemental Grant Program support startups?

The Innovate Alabama Supplemental Grant Program provides additional funds to businesses already receiving federal support like the SBIR. This helps promote projects that show potential for growth and innovation within Alabama.

What types of small business loans are accessible in Alabama for new companies?

Several loan programs are available to new companies, including those offered by the State Small Business Credit Initiative (SSBCI). These programs encourage lenders to provide credit to startups. The State Small Business Credit Initiative aims to boost economic development by making capital more accessible.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

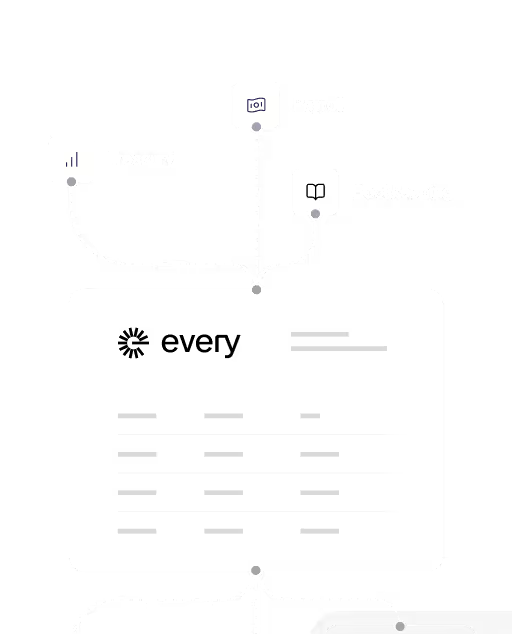

- What features does Every offer?

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

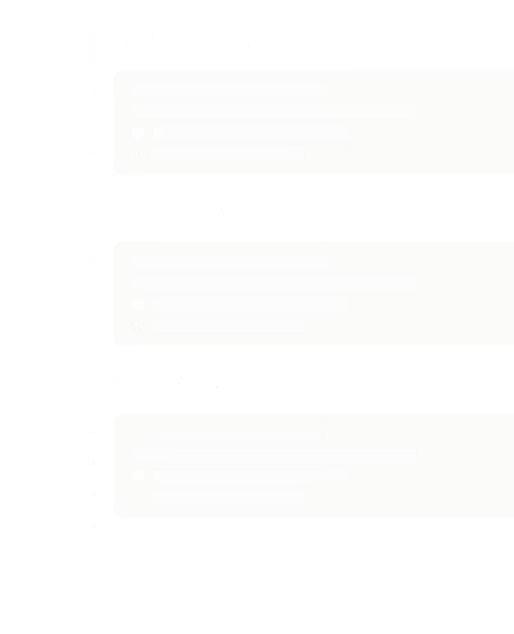

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?