List Of Startup Funding Programs In Indiana - 2025

What Are The Startup Funding Programs Available In Indiana?

Indiana offers a variety of funding programs to support startups. These opportunities range from state-sponsored programs to private funding sources aimed at boosting growth and innovation.

State-Sponsored Programs

Indiana provides several state-backed initiatives to help startups get off the ground. The Indiana Economic Development Corporation (IEDC) offers the EDGE Tax Credit and funding through programs like the Indiana Small Business Restart Grant Program. Another vital program is the State Small Business Credit Initiative (SSBCI), which provides additional funds to community lenders.

The Indiana Small Business Development Center (SBDC) offers guidance and resources to budding entrepreneurs. The Indiana State Trade and Export Promotion program supports those looking to expand outside U.S. borders. Programs like the Manufacturing Readiness Grants help modernize small businesses to maintain competitive edges.

Private Funding Sources

Private funding in Indiana is supported by organizations like Elevate Ventures, which collaborate with the IEDC to invest in startups. They manage the Legend Fund, providing pre-seed to early-stage funding to fuel growth in innovative sectors. This partnership has made significant investments in nurturing Indiana's startup ecosystem.

Additionally, support is available through Agrinovus, focusing on agri-tech advancements. Entrepreneurs can also benefit from venture capital networks and accelerators that are readily available in the state. These private funding channels provide essential backing for startups aiming to scale quickly.

How To Qualify For Funding Programs In Indiana?

Qualifying for startup funding in Indiana often requires meeting specific eligibility criteria and submitting necessary documentation. Potential applicants should pay close attention to these details to enhance their chances of securing financial assistance.

Eligibility Criteria

To qualify for funding programs in Indiana, startups often need to meet certain requirements. These may include being a registered business within the state and operating in eligible industries. Financial institutions and funding bodies might also look for a viable business plan that outlines how debt capital or grants will be used effectively.

Funding options like the Legend Fund specifically target minority-owned businesses, while others aim to assist underserved sectors. Additionally, programs like the Indiana Economic Development Corporation offer grants and incentives focusing on technology enhancements and workforce development.

Required Documentation

Startups must prepare several key documents to apply for funding programs. Common requirements include a detailed business plan that highlights objectives and expected outcomes. Financial statements such as balance sheets and income statements might also be necessary to demonstrate financial stability and future projections.

Applicants may need to provide documents relating to working capital and other financial histories. Specific programs can require additional documentation. For instance, government grants often require tax returns and proof of legal business status. It's essential to gather these papers ahead of time to streamline the application process and avoid any delays in securing Indiana small business grants.

What Are The Benefits Of Indiana's Funding Programs For Startups?

Indiana's funding programs are designed to boost startup growth, provide essential financial backing, and facilitate meaningful connections in the business community. These programs play a vital role in supporting entrepreneurial endeavors and fostering economic growth in the state.

Financial Support

Indiana offers robust financial support to startups, enabling them to access necessary capital to drive growth and innovation. The 21 Fund is a significant source of capital that helps startups with high growth potential. This fund, managed by the Indiana Economic Development Corporation, supports projects that aim to boost the state's economy by providing financial assistance for research and development.

Startups also benefit from grants and initiatives that are aimed at underserved sectors, encouraging economic development across various communities. By offering targeted financial support, Indiana facilitates the creation of jobs, fosters community development, and nurtures entrepreneurship. The availability of such funds helps startups focus on expanding their businesses, developing new products, and implementing digital innovation strategies without the constant pressure of financial constraints.

Networking Opportunities

Indiana's funding programs also provide valuable networking opportunities by connecting startups with mentors, investors, and business leaders. Through these programs, startups can tap into a network of industry professionals, gaining insights and technical assistance that are crucial for sustainable growth. Programs like the Legend Fund are designed to link entrepreneurs with the resources and expertise needed to succeed.

These connections can lead to collaborations and partnerships that enhance startup growth and drive workforce development. By engaging in these networks, startups not only gain access to capital but also benefit from shared knowledge and opportunities that contribute to innovation and entrepreneurship in Indiana’s vibrant business landscape.

How Do Indiana Funding Programs Compare To Other States?

Indiana offers robust funding programs supporting diverse sectors such as life sciences and agbioscience. Its initiatives include grants and loans that aim to boost local economies and promote sustainability. This section explores how Indiana's programs stack up against those of neighboring states and where Indiana ranks nationally in terms of business funding resources.

Comparison With Neighboring States

Compared to neighboring states, Indiana stands out with its strong focus on high-growth industries like agbioscience and life sciences. For instance, while Ohio and Illinois offer competitive funding, Indiana's State Small Business Credit Initiative provides comprehensive support from startups to established companies.

Indiana balances state and federal support to maintain programs that address specific business needs. Its diverse funding sources make it an attractive option for entrepreneurs. Additionally, the state's commitment to sustainability and renewable energy projects further strengthens its position. While other states also promote local economies, Indiana's strong industrial base in manufacturing gives it a distinct advantage.

National Ranking

On a national scale, Indiana ranks favorably in terms of supporting business innovation and growth. The state offers significant resources through programs like the Indiana State Trade and Export Promotion. In addition to state-level initiatives, Indiana benefits from federal programs that boost its national standing.

Indiana's economy benefits from a diverse industrial environment, which makes it a contender for aspiring entrepreneurs. It provides ample opportunities in key sectors such as agriculture, life sciences, and energy. While some eastern states have more funding options, Indiana's strategic focus on local industries makes it competitive. Entrepreneurs in Indiana can leverage these programs for a successful start and sustained growth within the state.

What Challenges Do Indiana Startups Face In Securing Funding?

Startups in Indiana face hurdles when trying to secure funding. These challenges often involve limited access to investors and intense competition for available resources. However, there are strategies that startups can use to navigate these challenges and improve their chances of obtaining necessary funds.

Common Obstacles

Indiana startups often encounter limited access to potential investors. The state does not have as many venture capital firms as larger states. This can lead to increased competition among small business owners and very small business entrepreneurs for the attention of investors.

Additionally, startup founders might struggle to meet the specific criteria or requirements set by funding programs. This demands time and effort in preparing thorough business proposals and financial plans. Also, navigating complex applications can be daunting for entrepreneurs without significant experience in finance. Understanding these challenges can prepare startups for the road ahead.

Strategies To Overcome Challenges

To increase their chances of securing funding, startups in Indiana can start by building strong networks with local business communities. Connecting with incubators or early-stage startup accelerators can link entrepreneurs with potential investors and mentors.

Another strategy involves focusing on clear and compelling business plans. Demonstrating a detailed market analysis and a clear revenue model can make a startup more attractive to investors.

Finally, leveraging government programs supporting Indiana startups can provide additional financial support. These programs often offer grants or matching funds that can ease financial burdens for startups. By adopting these approaches, Indiana startups can better position themselves to secure needed capital.

How Can Indiana Startups Best Utilize Funding Programs?

Indiana startups have a variety of funding options available to help them grow and achieve success. Utilizing these resources effectively requires strategic planning and a focus on long-term business goals.

Strategic Planning

Indiana startups should first assess their current financial needs and identify how they align with available funding programs. By understanding the specific criteria and benefits offered by each program, businesses can better target suitable opportunities.

Creating a detailed business plan is essential. This plan should outline how the funding will be used to drive growth, such as through venture capital investments or expansion into new markets. Startups should also consider developing milestones to measure progress and ensure accountability.

Networking is crucial. Engaging with mentors, investors, and other startups can provide valuable insights and potentially open doors to private investment opportunities. Building relationships with key stakeholders can increase credibility and facilitate access to financial resources.

Long-Term Growth

Once funding is secured, Indiana startups must focus on sustainable growth strategies. This involves investing in infrastructure, such as technology or personnel, that supports future expansion and scalability.

Allocating funds for research and development can lead to innovation and competitive advantage. Startups should also prioritize customer acquisition and retention strategies, ensuring that resources are directed toward building a loyal customer base.

It's important for startups to continuously evaluate their financial backing sources and adjust strategies accordingly. Private investment and other funding avenues often require flexibility as market conditions change. Maintaining a clear understanding of long-term goals helps in using these funds effectively, ensuring the business can adapt and thrive.

Are There Any Case Studies Of Successful Indiana Startups?

Indiana is home to many successful startups that have thrived in various industries. Let's look at some case studies that highlight the success stories of Hoosier entrepreneurs.

Lessonly

Founded in Indianapolis, Lessonly is a notable software company focusing on training and learning management. It grew rapidly by helping businesses train their teams effectively. The company's innovative approach and robust platform led to its acquisition by Seismic, a leader in sales enablement, expanding its reach significantly.

Springbuk

Springbuk, based in Indianapolis, is another success story. The company provides a health intelligence platform designed to guide employers in improving workforce health. Its data-driven solutions attracted much attention, driving its growth and establishing its place as a leader in healthcare analytics.

ActiveCampaign

Although now based in Chicago, ActiveCampaign was initially launched in Indiana. It offers cloud-based marketing and sales automation software, contributing to business success with personalized customer experiences. The startup's journey from Indiana highlights the potential of startups to make a global impact.

Innovating Hoosier Entrepreneurs

Indiana's vibrant startup ecosystem is shaped by the innovative spirit of its entrepreneurs. Organizations like the Venture Club of Indiana support these ventures by providing networking opportunities and resources. This support helps startups gain traction and scale their success stories.

Indiana continues to nurture a dynamic environment for startups across sectors. These case studies demonstrate the significant achievements of Indiana-based businesses, setting a strong precedent for future success.

Frequently Asked Questions

Indiana offers diverse funding resources for startups, including grants, venture capital, and accelerator programs. Startups can access various opportunities from both state-funded programs and private investors.

What resources are available for startup funding in Indiana?

Indiana provides multiple resources for startup funding. Programs like the State Small Business Credit Initiative focus on increasing capital for innovation. Additionally, entrepreneurs can explore grants and loans aimed at fostering small business growth.

How does one apply for the Indiana Restart grant?

Applying for the Indiana Restart grant requires understanding eligibility criteria and preparing necessary documents. Interested startups should visit the official Indiana State website for detailed instructions on application procedures and deadlines.

What types of funding options are typically available for early-stage companies?

Early-stage companies in Indiana can access a mix of grants, loans, and venture capital. Government-backed initiates assist with startup growth, offering crucial financial aid. Private investment options are also available to support fledgling businesses.

Are there specific venture capital firms that focus on Indiana startups?

Yes, several venture capital firms specifically target Indiana startups. They provide financial investments and guidance to foster innovation and growth within the state. Researching local venture capital and entrepreneurial programs can offer more insights into potential partners.

What State-funded programs exist to support startups in Indiana?

Several state-funded programs aim to bolster startup success in Indiana. For example, the SSBCI program promotes investment by leveraging additional capital. Other initiatives focus on grants that support small business development in diverse fields.

Which Indiana accelerators or incubators offer funding and resources to startups?

Indiana is home to several accelerators and incubators that provide funding and resources to startups. These organizations offer mentoring, investment opportunities, and networking programs designed to accelerate company growth. Engaging with these local entities can significantly benefit emerging businesses.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

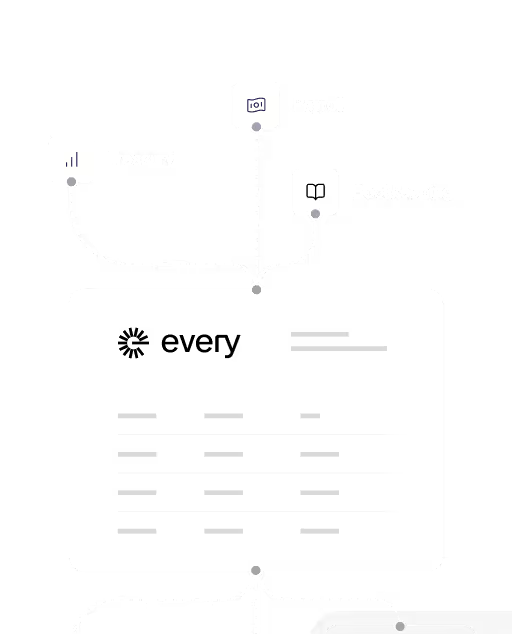

- What features does Every offer?

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?