Understanding Employer of Record (EOR): When Should you Hire an Employee vs a Contractor?

Why and what is EOR?

An Employer of Record or EOR helps companies in hiring both Employees and Contractors. We have the necessary tools, partners, and vendors needed to send payments, hire compliantly and process benefits on a global scale. This is important for businesses that aren’t registered in the country their new hire resides in. EOR serves as a cheaper alternative so that you as the Employer don’t have to worry about allocating time and resources to building incorporations, understanding the country’s employment law, or building relationships with local payroll and benefits providers.

What are the differences between Contractors and Employees?

Many countries ensure that there are strict lines that separate and define Contractors and Employees separate from one another. If you believe some of the “Employee” definitions describe the relationship your company has with your Contractor, read below on how to transition them to permanent employees to avoid any misclassification risk.

When should I hire a Contractor and when should I hire an Employee?

Employees have been proven to work with companies for a longer period of time. There is some correlation between time spent at a company and the benefits they’re provided, and as seen in the table above, there aren’t many Employer-provided benefits for Contractors. In addition to these benefits, employees also feel more protected by the local legislation related to labor law.

With this being said, hiring Contractors is never a bad idea. Your business may have needs in specific countries that are too expensive to incorporate into, especially if the need is for a short-term project. A lot of testing and preparation can be done by hiring an Independent Contractor in the country of your choosing to see how the individual works and whether or not there is enough business in that country for your team to invest more resources into. However, your team will also have to manage payments through invoicing, currency/foreign exchange conversions, and any country-specific legislation for Contractors.

An EOR that operates nationally can help to advise on the best route for you and your team; however, the decision of Contractor vs Employee is ultimately going to be based on your business needs.

What if I want my Contractor to be a permanent Employee?

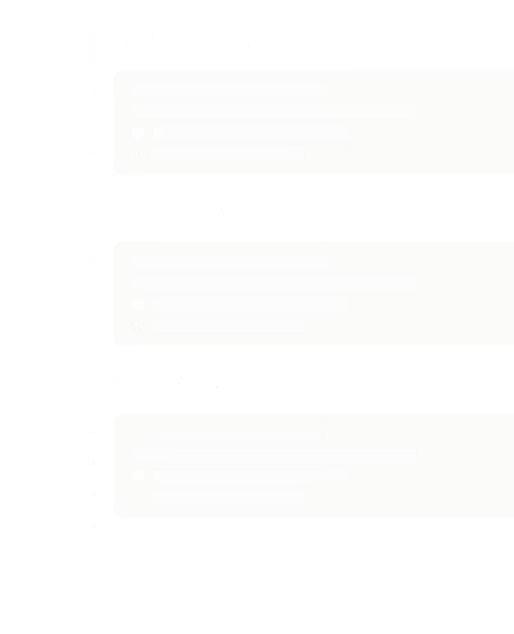

An EOR can help make the transition process for Contractors becoming permanent Full-time employees easy to manage. Everything from Payroll and tax registrations to benefits and pension enrolments plus any other country-specific compliance requirements are covered by the EOR. We simply need you to handle most of the communications and training while we take care of the rest.

The first step in processing this transition is communication. Is your Contractor aware of the changes to come? Some examples include:

- Change in take-home pay: Employees receive the net salary after the tax burdens have been processed by the EOR

- Change in currency: As a Contractor, there is much more flexibility in currency type. As an employee, the EOR as the legal employer will need to remit taxes and process pay in the country’s registered currency

- Benefits: Some countries require mandatory health benefits. Some others require a mandatory enrolment in a pension or retirement plan.

Once you’ve aligned with your Contractors on the transition, the EOR will be ready to guide you and your hire through the rest of the onboarding process from early welcome emails all the way up to the Employment Agreement execution.

What about terminations?

The EOR as the legal employer is responsible for terminations and the processes associated with it, including final pay, vacation payouts, benefits continuation or termination, and record of employment. Similar to the onboarding process, the EOR will be responsible for communicating all steps of the termination process in relation to the country’s labor laws and will manage all expectations before anything is communicated to the employees.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

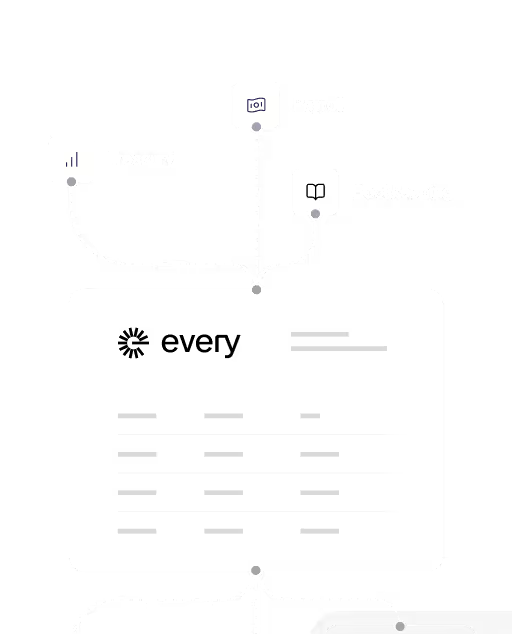

- What features does Every offer?

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?

.png)

.png)

.png)