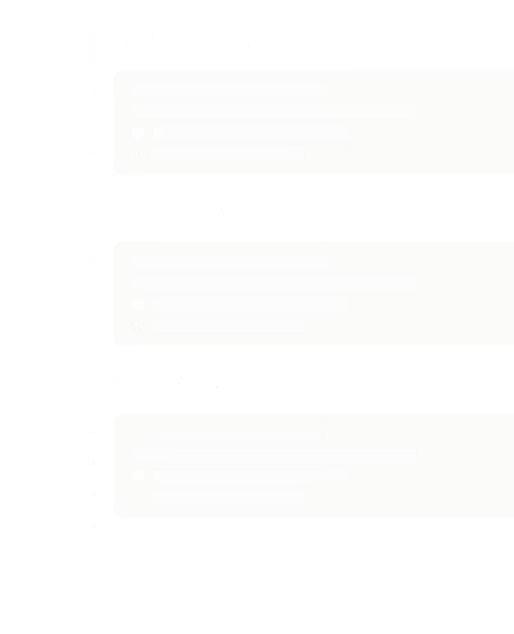

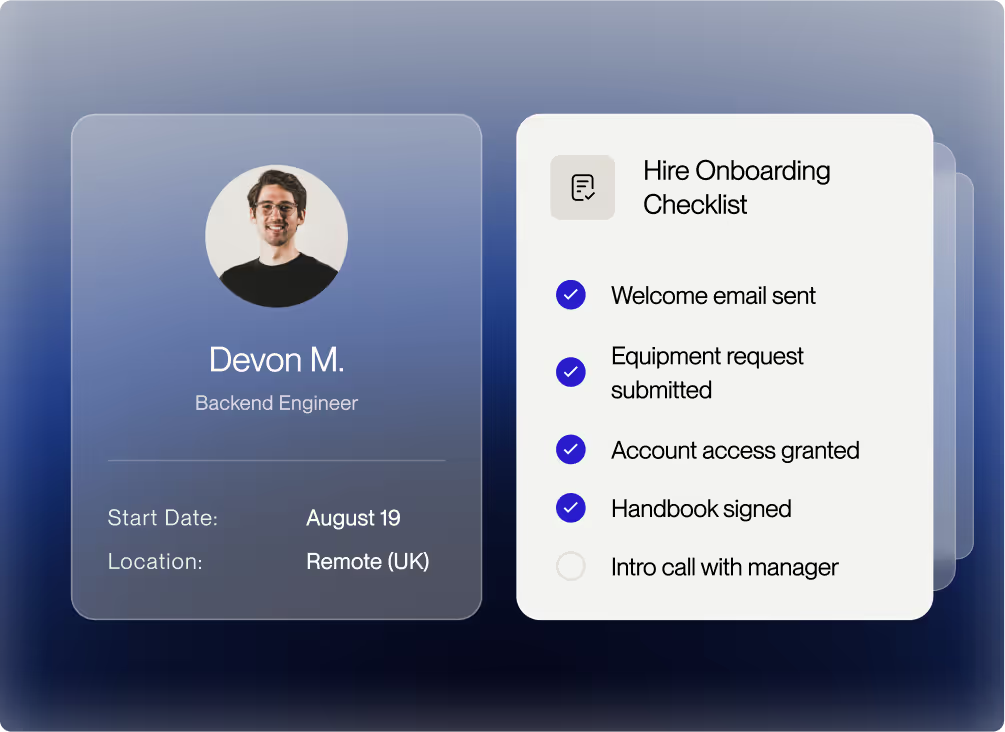

Employee Onboarding Checklist

Congrats, you’ve hired your first employees! Now what? You’ll need to onboard your employees to set them up for success, as well as adhere to key federal and state labor regulations.

Here's an onboarding checklist to help you get started.

1. Signed Offer Letter & Employee Contract

Once you receive the offer letter & employee contract signed by both parties (yourself and your new hire), you’ll need to make sure you file it safely and securely.

2. Signed Background Check FCRA Authorization Form

You’ll also need to ask your new hire to sign a background check FCRA authorization form, so you can legally conduct a background check. Vendors that can help with employee background checks.

3. Verify Your New Hire Can Legally Work in the US

On your employee’s first day, you and your new hire will need to fill out Form 1-9 to verify your employee’s identity and authorization to work in the US.

You’ll need to ask and review your employee’s passport, green card, work visa, or birth certificate to correctly fill out this form and confirm their right to work in the US.

You must ensure that you correctly complete and store the Form I-9 for each employee within three business days of their start date.

You don’t need to submit the form to any government agency, but you do need to legally file it and have it ready should an agency request it.

4. Collect W-4 Tax form and Social Security Number

Ask all new employees to submit a signed W-4 form upon starting work and keep it on file. This form will help you determine how much income tax to withhold from an employee’s wages.

You’ll also be required to get your employee’s Social Security number. Don’t accept ITIN in place of a Social Security number. ITIN numbers begin with 9 and do not signal eligibility to work in the United States.

You’ll need to include their Social Security number when you file their W-2 form at the end of the year with the IRS to report the employee’s wages and taxes withheld for tax filing.

Also, be sure not to confuse the W-2 with the W-4 form. The main difference between the W-2 and W-4 is their purpose. The W-2 is issued by employers annually to report wages and taxes withheld for tax filing. In contrast, the W-4 is completed by employees to determine the amount of federal income tax that should be withheld from their paychecks.

Resource: Here are all the IRS forms you’ll need to collect on your employee’s first day of work.

5. Set up Employee Payroll & Tax Withholdings

Set up Payroll

- You’ll need to make sure you pay your employees on a regular and timely basis.

- Payroll information should be recorded and filed.

- Request direct deposit bank information to set up your employee’s automatic payroll.

Register with the IRS and State Payroll Tax Accounts

- By law, you’ll also need to withhold taxes from your employees’ salaries, including federal, state, social security, and Medicare.

- You will also need to report these withholdings to the IRS on a quarterly basis.

- To do this, you’ll need to get a Federal Employer Identification Number (FEIN) by applying online through the IRS website.

- You’ll also need to register with the state(s) where you hire employees. Many states have easy online platforms for registering your business and obtaining a state payroll tax account number.

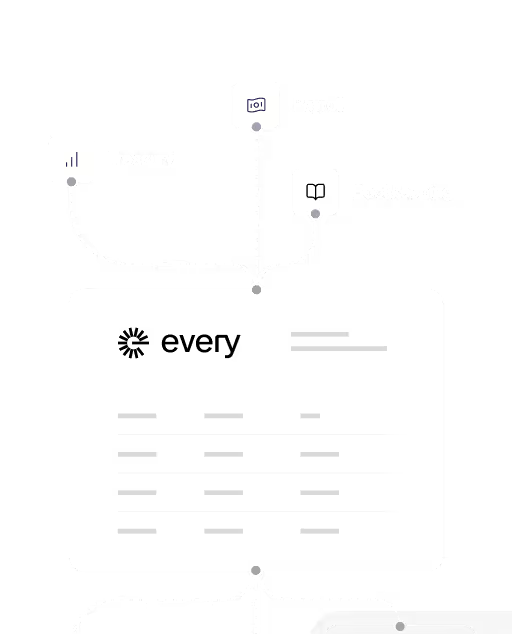

With Every, you can put onboarding steps on autopilot from Day 1. We handle state payroll tax registrations and filings, saving founders hours of work and helping you avoid penalties and paperwork.

When you onboard someone with Every, you select whether they are an employee or a contractor. We’ll send the appropriate offer letter and contract for them to sign, as well as collect the necessary I-9 (employees) or W-9 (contractors) forms, set up payroll information, and withhold and file state and federal taxes.

Note: You’ll still need to review your new hire’s passport, visa, or birth certificate to confirm their right to work in the US and complete the I-9 form, which should then be uploaded to our platform.

We’ll also store these documents and employee data securely on our platform on your behalf.

Discover how Every can assist you with employee onboarding.

{{ebook-quote-4}}

6. Signed Employee Handbook Acknowledgement

Once you’ve hired a few employees, you may want to create an employee handbook with your company values, code of conduct, and other workplace policies.

Send the employee handbook to your new employee to review and sign, and then file it securely. It may protect you against any future employee lawsuits, so hang on to it.

7. Benefits Enrollment

Workers’ Compensation (required benefit by law): Once a non-owner W-2 full-time employee is hired, Workers’ Compensation Insurance will be required in most states.

Healthcare benefits (required by law with 50+ employees or to stay competitive): You’ll also want to share information on the medical, dental, and other benefits that you offer with your new employee, so they can enroll in their new benefits.

401(k) benefit: Some states, like California, require you to offer a 401(k ) benefit with 5+ employees or enroll employees in CalSavers for retirement plan savings options.

8. Report New Hire to the State

Employers are required by federal law to report a new hire to the State within 20 days of their first day at work. Each state varies, so be sure to check the specific regulations.

9. Ensure Data Privacy & Security and Document Compliance on Day 1

You will also need to ensure that you collect and store your employees’ data securely to comply with data privacy laws and avoid potential lawsuits down the road.

This confidential data includes payroll information, home addresses, bank accounts, background checks, performance reviews, offer letters, termination documents, stock plans, and other relevant documents.

Additionally, employee documents, such as the I-9 form (for employment verification) and the W-2 form (for tax purposes), must be stored correctly and kept on file for a minimum of several years, as mandated by federal regulations.

Relying on third-party HR and Payroll platforms like Every can help ensure that your employees’ data and documents are securely stored according to federal laws.

10. Employee Onboarding Training & Mentoring

Most importantly, you’ll want to set your employee up for success by investing the time in onboarding, so they can start running on Day 1.

Remember, as a CEO of a startup, you’re also a manager, so don’t just throw your new hire in the deep end. Give them a lifebuoy at the beginning to help them survive and thrive at your startup.

Here’s what you can do:

- Create an employee onboarding doc to help bring them up to speed quickly. Include links to key documents and slide decks about your product, market, and company, as well as an org chart on who does what.

- Create a list of key people they should meet 1:1 within their first few weeks.

- Create a 30-90-180 day plan on key deliverables you would like your new employee to achieve in this timeframe.

- Set up weekly 1:1 meetings with your new hire to ensure they are aligned, give feedback, and check in on key deliverables. Startups pivot quickly, so keep them in the loop.

- Host a welcome lunch to welcome them to your startup. As you grow, you can throw in some company swag.

Conduct any required compliance training for your new hires as mandated by federal and state regulations. For example, in California, sexual harassment training is required if your startup has 5 employees or more. Vendors can provide online courses that your employees can take to ensure compliance.

If you found this helpful, you’ll get even more from the full Founder’s HR Guide.

{{ebook-cta}}