How To Register LLC In Oregon - 2025

Understanding LLCs in Oregon

A Limited Liability Company (LLC) in Oregon is a popular business structure due to its flexibility and liability protection. Unlike corporations, LLCs offer personal liability protection without the formalities. This makes them appealing for small business owners.

In Oregon, forming an LLC requires choosing a unique business name. It must include the term "LLC" or "Limited Liability Company." This ensures legal recognition as a separate business entity.

LLCs provide liability protection, shielding personal assets from business debts. This is particularly valuable for entrepreneurs. It allows them to take business risks without risking personal property.

Taxation is straightforward for LLCs as they are typically considered pass-through entities. This means the profits pass through to the owners, who report them on personal tax returns. Single-member LLCs are taxed like sole proprietorships, simplifying the process further.

Besides the benefits, LLCs must operate with a registered agent in Oregon. This agent receives legal documents on behalf of the business. An Oregon address is required for the registered agent.

For more detailed steps on how to start, you can visit this guide to forming an LLC in Oregon.

They offer a strong balance of simplicity, protection, and tax advantages, making them a great choice for many entrepreneurs in the state. To ensure compliance, maintaining accurate records and timely filings is crucial.

Starting Your Oregon LLC

Setting up an LLC in Oregon involves several key steps. These include choosing a unique name, selecting a registered agent, filing the necessary documents, drafting an operating agreement, and obtaining an Employer Identification Number (EIN).

Name Selection

Selecting a name is the first step to start a business in Oregon. The name must be unique and include "LLC" or "Limited Liability Company." It should not be easily confused with existing business names in Oregon. Checking the availability of your desired name on the Oregon Secretary of State's website is important.

You might also consider reserving the name for a small fee before officially registering it. This can ensure that the name remains available while you prepare your filing documents. A clear and memorable name helps in branding and promotes easy recognition.

Registered Agent Requirements

An Oregon LLC must have a registered agent. This agent is designated to receive legal documents and government notices on behalf of the LLC. The agent must have a physical address in Oregon, not just a P.O. Box.

The registered agent can be an individual or a business entity. Choosing a reliable agent is crucial, as they play a significant role in the company's legal standing. Some business owners prefer to hire a professional service to fulfill this role to ensure privacy and convenience.

Articles of Organization

Filing the Articles of Organization is a critical step to form an LLC. This document contains essential information, such as the LLC's name, address, and the details of its registered agent. It must be filed with the state of Oregon with a filing fee.

In Oregon, the filing can be done online or by mail, which makes it flexible for business owners. Once approved, your LLC becomes officially recognized by the state. It’s essential to review the articles carefully before submission to avoid errors that might delay the process.

Operating Agreement Drafting

While not required by Oregon law, creating an operating agreement is a vital step. This document outlines the management structure and operating procedures of the LLC. It includes roles, responsibilities, and provisions for changes or disputes.

An operating agreement helps prevent misunderstandings and makes management clear. Even single-member LLCs can benefit from having a structured plan. Including details like voting rights, profit-sharing, and exit strategies can protect all members involved.

Employer Identification Number (EIN)

Obtaining an Employer Identification Number (EIN) from the IRS is important even if the LLC has no employees. The EIN is used for tax purposes and to open a business bank account. It’s essentially the business's Social Security Number.

The application for an EIN can be completed online and is generally processed quickly. This number ensures that the LLC complies with federal tax regulations and helps maintain clear financial records. It also separates personal and business finances, adding an extra layer of liability protection.

Filing and Compliance

Completing the registration of an LLC in Oregon involves several important steps. Understanding these will help ensure compliance with state requirements and avoid unnecessary complications.

Business Registration

To start an Oregon LLC, file the Articles of Organization with the Oregon Secretary of State. This can be done through the state's Business Registry online, which is a convenient method. The filing fee for this process is $100. It's important to appoint a registered agent in Oregon to handle service of process and official documents. For foreign LLCs, the procedure involves additional steps, such as submitting a foreign registration statement.

Annual Reporting Requirements

Every year, an Oregon LLC must submit an annual report to the Oregon Secretary of State. This report updates information about the business, like the registered agent and company address. The deadline for filing is the anniversary of the LLC's original registration. An annual fee of $100 is required for domestic LLCs and $275 for foreign LLCs. Keeping this information current is critical for maintaining compliance and ensuring the business remains active.

Tax Obligations

In Oregon, LLCs have several tax obligations managed by the Department of Revenue. Most LLCs can elect how they wish to be taxed, but will generally need to pay state income taxes. While Oregon doesn't impose a sales tax, there may be other local taxes to consider. LLC owners should also be aware of any federal taxes if they operate across state lines. It's helpful to consult tax professionals to ensure all obligations are met accurately.

Regulatory and Licensing Considerations

Compliance with Oregon's requirements may involve securing additional business licenses and permits. Depending on the LLC's industry and location, various state or municipal permits may be necessary. The UCC (Uniform Commercial Code) filings might be required for certain businesses, especially those dealing with personal property finance. Researching and securing the necessary licenses ensures that the LLC operates legally within state guidelines. Avoiding these steps can lead to fines or operational shutdowns.

Completing Required Documentation

Completing the necessary paperwork for registering an LLC in Oregon is straightforward. Key steps include submitting forms either online or by mail, conducting a business name search, and securing the registered agent documentation. Each step has specific requirements that need attention.

Filling Online or by Mail

To register an LLC in Oregon, individuals can choose to submit their forms either online or by mail. Using the Oregon Secretary of State's website, online filing is generally quicker and more convenient. It allows applicants to quickly complete forms and pay fees with a credit card.

For those who prefer traditional methods, mailing the forms is an option. Mailing requires attention to detail to avoid delays due to errors. All forms must be filled accurately, including the Articles of Organization, and all necessary fees should be included.

Name Reservation and Search

Before finalizing the LLC registration, conducting a thorough business name search is crucial. This ensures that the desired business name is available and not already in use. In Oregon, it is also possible to reserve a name for up to 120 days to secure the LLC’s desired title.

Name reservation fees apply, and this step prevents others from registering under the same name. It is also important to consider if an assumed business name might be needed, especially if planning to operate under a different name than the registered LLC.

Registered Agent Documentation

Every LLC in Oregon must designate a registered agent to receive legal documents on its behalf. This person or entity must be located in Oregon. The registered agent information should include their full name, physical address, and consent to serve as the agent.

A registered agent service can be hired if necessary, offering professional assistance and ensuring compliance with state rules. Proper documentation related to the registered agent must be filed with the state to complete the LLC registration process effectively.

Expanding Your LLC

Expanding an LLC in Oregon involves registering as a foreign LLC if expanding into other states and understanding the professional services and benefits that support growth. These steps are essential for ensuring legal compliance and leveraging opportunities.

Foreign LLC Registration

When an Oregon LLC seeks to operate in another state, it must register as a foreign LLC. This includes filing necessary paperwork and paying applicable fees in the new state. The process typically requires submitting a Certificate of Good Standing from Oregon and having a physical street address in the new state.

Additionally, foreign LLCs need to appoint a registered agent who can receive legal documents. This ensures the business remains compliant with the state's regulations and can operate smoothly across state lines. An operating agreement, though not always mandatory, helps in defining internal management and operational procedures for the LLC.

Professional Services and Benefits

Using professional services such as an LLC formation service, can simplify the expansion process. These services handle tasks like filing paperwork, maintaining a registered agent, and managing compliance. For expanding LLCs, it is also important to understand the benefits of professional services, which can include tax advantages and liability protections.

LLCs must also file a beneficial ownership information report, ensuring transparency in ownership structures. Furthermore, having access to experts who understand state-specific laws and regulations aids in making informed decisions. This approach allows businesses to focus on growth rather than administrative burdens, leveraging professional insights for successful expansion.

Essential Additional Provisions

When forming an LLC in Oregon, it's crucial to consider optional provisions. These can be included in the Articles of Organization to tailor the LLC's operations to specific needs. They help outline how the business is managed, voting rights, and procedures for adding or removing members.

LLCs in Oregon must also comply with regulatory requirements. This may involve appointing a registered agent with an Oregon address. The registered agent handles legal documents on behalf of the LLC, ensuring that important information reaches the right people.

Personal liability protection is a significant benefit of forming an LLC. Members are generally not personally responsible for business debts, which helps safeguard personal assets. This protection is a key consideration for many entrepreneurs.

Oregon requires a $100 state fee to file the Articles of Organization. Additionally, each LLC must file an annual report and pay a renewal fee. This ensures that the LLC remains in good standing and the information stays current.

Including clear additional provisions can streamline operations and minimize disputes. Business owners may want to seek legal advice to ensure that all provisions are appropriately detailed and relevant to their specific situation.

For more detailed steps and requirements, visit the State of Oregon's business page. This comprehensive guide covers everything from filing paperwork to ongoing compliance needs, ensuring a smooth registration process for businesses.

Frequently Asked Questions

These questions cover common concerns about forming and registering an LLC in Oregon. Understanding the process, requirements, and associated costs is crucial for new business owners.

What are the steps to register an LLC in Oregon?

To register an LLC in Oregon, choose a unique business name, select a registered agent, and file the Articles of Organization with the Oregon Secretary of State. The filing can be completed online or via standard mail.

What are the necessary requirements to form an LLC in Oregon?

Essential requirements include a distinct LLC name, a registered agent in Oregon, and the filing of the Articles of Organization. An Employer Identification Number (EIN) is also recommended for tax purposes.

How can one conduct an LLC name search through the Oregon Secretary of State?

To search for an LLC name, visit the business name search page on the Oregon Secretary of State's website. This ensures the name is not already in use, satisfying state requirements for uniqueness.

What is the process for filing LLC registration documents online in Oregon?

LLC documents can be filed online through the Oregon Secretary of State's portal. The process requires creating an account and completing the form submission for the LLC, after which the appropriate fee is paid.

How long does the Oregon Secretary of State take to approve an LLC?

The processing time for LLC approval in Oregon can vary, though it generally takes a few days. For exact timelines and updates, check directly with the Secretary of State's office.

What fees are associated with forming an LLC in Oregon?

The standard filing fee for establishing an LLC in Oregon is $100. This fee covers the submission of the Articles of Organization with the Secretary of State. Additional fees may apply for optional services.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

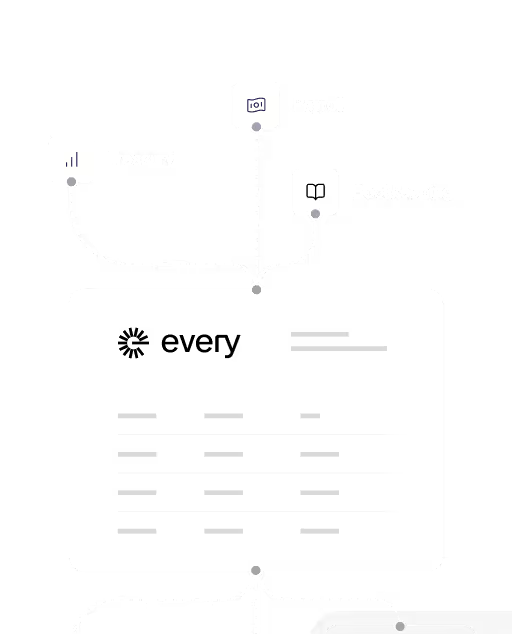

- What features does Every offer?

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?