List Of Startup Funding Programs In Louisiana - 2025

What Are The Key Startup Funding Programs In Louisiana?

Louisiana offers a variety of funding opportunities for startups. These include government-funded programs like grants and loans, private investment options, and specialized grants aimed at fostering innovation.

Government-Funded Options For Startups

Government programs in Louisiana provide significant support for startups through grants and loans. The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are central to these efforts. They both offer funding to qualifying small businesses focusing on technological progress.

The State Small Business Credit Initiative (SSBCI) Program is another key resource. It aims to enhance access to capital by leveraging federal dollars, directly benefiting early-stage startups and helping them scale.

Private Investment Opportunities

Private investors are crucial for startup growth. Seed capital is often provided by angel investors or venture capitalists who seek promising new businesses. These investors not only offer financial backing but also bring valuable mentorship and industry connections.

While state-level investment programs are available, private entities often focus more on technological innovation and market potential. Connecting with local business networks can help startups find suitable private investment partners.

Grants And Scholarships Available

Louisiana's grants, like the Louisiana Innovation Retention Grant, provide substantial support. This program awards up to $100,000 to eligible small businesses, helping retain STEM companies and their workers.

Scholarships are less common for startups, but some educational institutions offer entrepreneurial grants to assist student-led ventures. These programs often target projects with innovative solutions and community impact. Exploring local university offerings can be beneficial for startups seeking additional support.

How Can Startups Qualify For Funding In Louisiana?

Startups in Louisiana can access various funding options. Eligibility often depends on factors like the stage of business development and whether applicants meet specific criteria. Funding is available from both government programs and private investors.

Eligibility Criteria For Government Programs

To qualify for government funding programs in Louisiana, startups must typically meet certain eligibility requirements. These may include having a business plan and proving the potential for job creation. Programs like the State Small Business Credit Initiative (SSBCI) can be vital for accessing capital. Some initiatives focus on supporting socially and economically disadvantaged individuals (SEDIs) to foster inclusivity.

Startups often need to demonstrate innovation, particularly if they're looking at grants like the Small Business Innovation Research (SBIR). Applicants may have to provide detailed proposals and undergo application reviews. Many programs also prioritize businesses that will positively impact the state's economy.

Requirements For Private Investments

Private investors in Louisiana often look for specific criteria when deciding to fund startups. A clear vision and a strong business model are essential. Investors may prioritize companies with unique products or technologies that fill a market gap. Demonstrating potential return on investment (ROI) is crucial to attracting interest.

Networking and presenting a successful track record can benefit startups seeking private funding. Building relationships with investors and effectively communicating business goals and growth strategies are key. Utilizing resources like the Delta Regional Authority Investments can provide additional support for startups aiming to secure investment.

What Are The Benefits Of Startup Funding Programs?

Startup funding programs play a crucial role in helping new businesses succeed. They offer not only the essential financial support needed to start and grow but also provide valuable connections and guidance through networking and mentorship opportunities.

Financial Support And Growth

Startup funding programs offer vital financial assistance that helps early-stage businesses grow. These programs often involve capital investments from venture capital funds and early-stage investment funds. They provide private financing that can help startups hire staff, develop products, and expand their market reach. This financing is especially important for businesses that might otherwise struggle to get loans from traditional banks due to a lack of credit history or collateral. As the businesses grow, they can contribute to job creation, benefiting local economies by providing new employment opportunities.

Networking And Mentorship Opportunities

In addition to financial support, these programs offer valuable networking and mentorship opportunities. Entrepreneurs can connect with experienced investors and business leaders through events like CEO roundtables. Such interactions give them insights into managing and scaling their ventures. These connections often lead to partnerships, collaborations, and sometimes even additional investments. For young startups, having access to advice from seasoned mentors can be a game-changer, helping them navigate challenges and make informed decisions. Networking opportunities also enable startups to build communities, share knowledge, and stay informed about industry trends. In Louisiana, programs like the Louisiana SSBCI Seed Capital Program provide such valuable connections.

Are There Any Risks Associated With Startup Funding?

Startup funding can help businesses grow, but it also comes with risks. These risks can affect loan repayment and the balance of ownership through equity sharing. Being aware of these challenges helps startups make informed decisions.

Potential Drawbacks Of Investments

Investors often provide funds in exchange for equity in a company. This can mean sharing decisions and profits with them. For some startups, the input from investors is valuable, but others may find it limiting. There's also a risk that timing of startup investment will affect potential rewards, especially if early assumptions don't pan out. Additionally, financial performance can be scrutinized regularly, which may create pressure for immediate results.

Loans and loan programs might come with interest or fees, affecting financial health. While these might seem manageable at first, any delay in payment can lead to added costs or even loss of assets if collateral is involved. It's important for startups to assess funding risks like economic fluctuations that might impact their ability to service these debts.

Managing Debt And Equity Sharing

Debt is a necessary part of many startup operations through loans or micro-lending. To handle debt well, startups need solid financial plans. This involves being clear on payment schedules and understanding interest rates. Collateral support might mean that personal or company assets back the loans, so financial risk becomes personal as well.

Equity sharing involves giving away part of the company ownership in exchange for funding. It can dilute original stakeholders' control and profits. This is why choosing the right equity programs is vital. It helps in maintaining a balance between acquiring necessary funds and retaining autonomy. Exploring all options, like loan guaranty programs, may offer better suited financial tools for both immediate and future needs.

What Are The Most Successful Examples Of Funded Startups In Louisiana?

Louisiana is home to several successful startups that have leveraged funding programs to achieve growth. These companies have utilized federal research dollars, venture capital, and state resources to innovate in various sectors, including technology and business innovation.

Case Studies Of Successful Startups

Resilia, founded in 2016, is a great example of a vibrant startup in the state. This company focuses on helping non-profits and other organizations manage operations more efficiently. It has gained recognition and financial backing due to its innovative solutions and growth potential. More information on startups like Resilia can be found on Crunchbase's list of Louisiana Startups.

In North Louisiana, several startups have been recognized by the Entrepreneurial Accelerator Program. These businesses, ranging from technological innovations to local enterprises, have collectively created over 700 jobs and an annual payroll exceeding $25 million. This growth showcases the effectiveness of both state and federal support systems in nurturing success for new enterprises.

Lessons Learned From Funded Startups

Successful startups in Louisiana demonstrate the importance of utilizing various funding sources, from phase II funds to technology grants. Entrepreneurs should consider these lessons: first, leverage multiple funding channels to ensure financial stability. Second, focus on innovation. Businesses that stand out often have unique approaches to solving problems.

Connecting with local entrepreneurship programs can offer valuable guidance. They provide networking opportunities and insights into obtaining research-focused startup funding. Building strong networks with investors and stakeholders is crucial. Interested startups can learn more about funding opportunities through resources like the Tech Tribune's list of best tech startups in Louisiana.

How Does The Application Process For Funding Work?

Startups seeking funding in Louisiana can choose between government programs and private investors. Each involves specific steps and considerations. This section breaks down what is essential to secure funding in these two distinct pathways.

Steps To Apply For Government Funding

Government funding often involves detailed procedures. Start with research to find programs that match your startup's needs. Each program might have distinct eligibility criteria, so ensure your business aligns with these requirements. Applications typically involve submitting a grant application, which outlines your startup's objectives, budget, and expected outcomes. Pay close attention to deadlines, as many government grants have strict submission timelines.

The application process may include multiple phases, starting with Phase I, where you submit initial proposals. Successful proposals may progress to Phase II, which requires more detailed plans and negotiations. Utilizing resources such as US Government Funding Options for Startups can provide valuable guidance on navigating this process.

Approaching Private Investors

Engaging private investors involves a different approach, often requiring networking and personal connections. Start by crafting a compelling pitch that succinctly outlines your business model, potential market, and growth projections. Be prepared to present financial forecasts and a solid business plan. Investor meetings focus on convincing them of your startup's viability and potential return on investment.

Gather references and testimonials to bolster your case. Understanding investor preferences and tailoring presentations to them can enhance success rates. Platforms like Funding 101: How a Startup Gets Funding offer insights on preparing for investor meetings. Personalization and confidence are crucial in these interactions, making your startup stand out in competitive funding landscapes.

What Trends Are Shaping Startup Funding In Louisiana?

Louisiana's startup funding landscape is transforming with new focus areas. Key trends include a strong appeal for investment in emerging industries and shifts in funding patterns due to economic changes. These trends are reshaping access to capital for local innovators.

Emerging Industries Attracting Investment

In Louisiana, emerging sectors like technology and renewable energy are catching the attention of investors. The Louisiana Innovation Retention Grant program, a strategic move by Louisiana Economic Development, aims to retain startup companies by providing necessary capital. This approach helps foster growth in high-potential sectors, giving startups the opportunity to thrive.

The state's focus on diversifying its economy further fuels this interest. Investors are keen on businesses that align with sustainability and technological innovation. As industries like clean energy grow more prominent, startups in these niches could see increased funding opportunities. This strategic shift helps bring long-term benefits to both the local economy and aspiring entrepreneurs.

Impact Of Economic Changes On Funding

Economic changes significantly impact how funds flow to startups in Louisiana. Federal initiatives have introduced new financing programs, altering the funding landscape. Notably, programs under the U.S. Department of Treasury and Louisiana Economic Development Corporation (LEDC) are expanding access to capital for innovative projects.

Local economic policies also influence funding trends. Efforts aimed at economic development focus on creating a supportive environment for startups. By leveraging more than $15 billion in government grants, the business sector in Louisiana becomes a vital part of the state's growth strategy. This shift means startups can access diverse funding options, increasing their chances to secure needed financing.

Frequently Asked Questions

Louisiana offers a variety of funding programs to assist small businesses, including grants for specific groups and programs designed to boost startups. Details on these offerings help startups and small business owners understand their options for financial support and opportunities for growth.

What types of small business grants are currently available in Louisiana?

Louisiana provides grants aimed at supporting startups and other small businesses. These grants can help with startup costs, working capital, or even specific sector growth. Information on these programs is available through websites like the Louisiana SSBCI site.

How can women entrepreneurs access small business grants in Louisiana?

Women entrepreneurs in Louisiana can find specific grants and programs. These may be offered through nonprofit organizations or government-backed initiatives. Details about such opportunities are accessible through resources like the List Of Startups Grants In Louisiana.

What is the Louisiana Seed Capital Program, and how does it benefit startups?

The Louisiana Seed Capital Program (LSCP) provides financial assistance to early-stage companies. It aids startups by offering seed money that can be used for initial operations and growth activities. This support is crucial for socially and economically disadvantaged individuals looking to fund their businesses.

Does Louisiana Economic Development offer specific grants or programs for startups?

Yes, Louisiana Economic Development provides various programs and resources to support startups. These include funding and small business support services aimed at fostering economic growth and innovation throughout the state.

What are the requirements to qualify for the $15,000 small business grant in Louisiana?

To qualify for this grant, small businesses must meet certain criteria, often related to the nature of the business, its location, and its economic impact. They may need to demonstrate need and potential for growth. Programs may be further delineated by specific project goals or community impact.

How can Louisiana-based small businesses obtain loans or financial assistance?

Small businesses in Louisiana can access loans and financial aid through lenders participating in state and federal programs. The Louisiana Small Business Development Center offers resources and technical assistance to help businesses navigate the loan process and other financial resources.

Up to 3,500 bonus and 3% cash-back on all card spend [3], 6 months off payroll, and 50% off bookkeeping for 6 months, free R&D credit.

Frequently Asked Questions

- How do I sign up for Every?

You can get started right away—just click “Get Started” and follow a short onboarding flow. Prefer a little help? One of our specialists can walk you through incorporation, banking, payroll, accounting, or whatever you need.

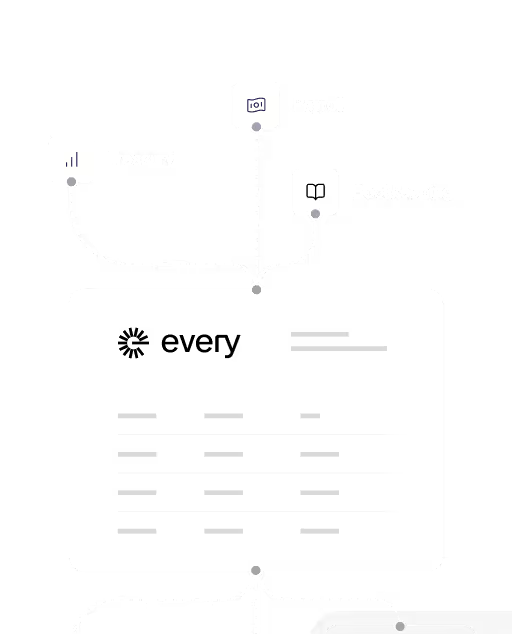

- What features does Every offer?

Every gives startups a complete back office in one platform. From incorporation and banking to payroll, bookkeeping, and tax filings, we take care of the operational heavy lifting—so you can spend more time building, less time managing.

- How is Every different from other tools?

Most competitors give you software. Every gives you a full-stack finance and HR team—plus smart financial tools that actually benefit founders. Earn up to 4.3% interest on idle cash and get cash back on every purchase made with your Every debit cards, routed straight back to you.

Every is not a bank. Banking services provided by Thread Bank, Member FDIC. Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when Thread Bank places them at program banks in its deposit sweep program. Pass-through insurance coverage is subject to conditions. The Every Visa Business Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Is my data secure with Every?

We use end-to-end encryption, SOC 2-compliant infrastructure, and rigorous access controls to ensure your data is safe. Security isn’t a feature—it’s foundational.

Can I switch to Every if my company is already set up?Yes—you can switch to Every at any time, even if your company is already incorporated and running. Whether you're using separate tools for banking, payroll, bookkeeping, or taxes, we’ll help you bring everything into one place. Our onboarding specialists will guide you through the process, make sure your data is transferred cleanly, and get you set up quickly—without disrupting your operations. Most founders are fully transitioned within a week.

- What stage of startup is Every best for?

Every is designed for startups from day zero through Series A and beyond. Whether you're just incorporating or already running payroll and managing expenses, we meet you where you are. Early-stage founders use Every to get up and running fast—with banking, payroll, bookkeeping, and taxes all handled from day one. Growing teams love how Every scales with them, replacing patchwork tools and manual work with a clean, unified system.

We’re especially valuable for teams who want to move fast without hiring a full finance or HR team—giving founders more time to build, and fewer distractions from admin and compliance

- How long does onboarding take?

Onboarding with Every is fast and efficient. For most startups, the process typically takes between 3 to 7 days, depending on your specific needs and how much setup you already have in place.

If you're a new company, you'll be up and running quickly—getting your banking, payroll, and bookkeeping set up without hassle. If you’re transitioning from another system, our specialists will help you migrate your data, ensuring a smooth switch with no gaps or errors in your operations.

We guide you every step of the way, from incorporation to setting up automated payroll to handling your taxes—so you can focus on growing your business. Our goal is to make sure you're fully operational and confident in your back office in under a week.

Practical Questions to Ask to Ensure Your Bank is Well Managed

How much liquidity does the bank have on hand to cover unexpected withdrawals or shortfalls?

What percentage of the bank's deposits are invested in longer-term securities and loans, and what percentage is kept as cash reserves?

How does the bank diversify its investment portfolio to minimize potential losses and reduce risks?